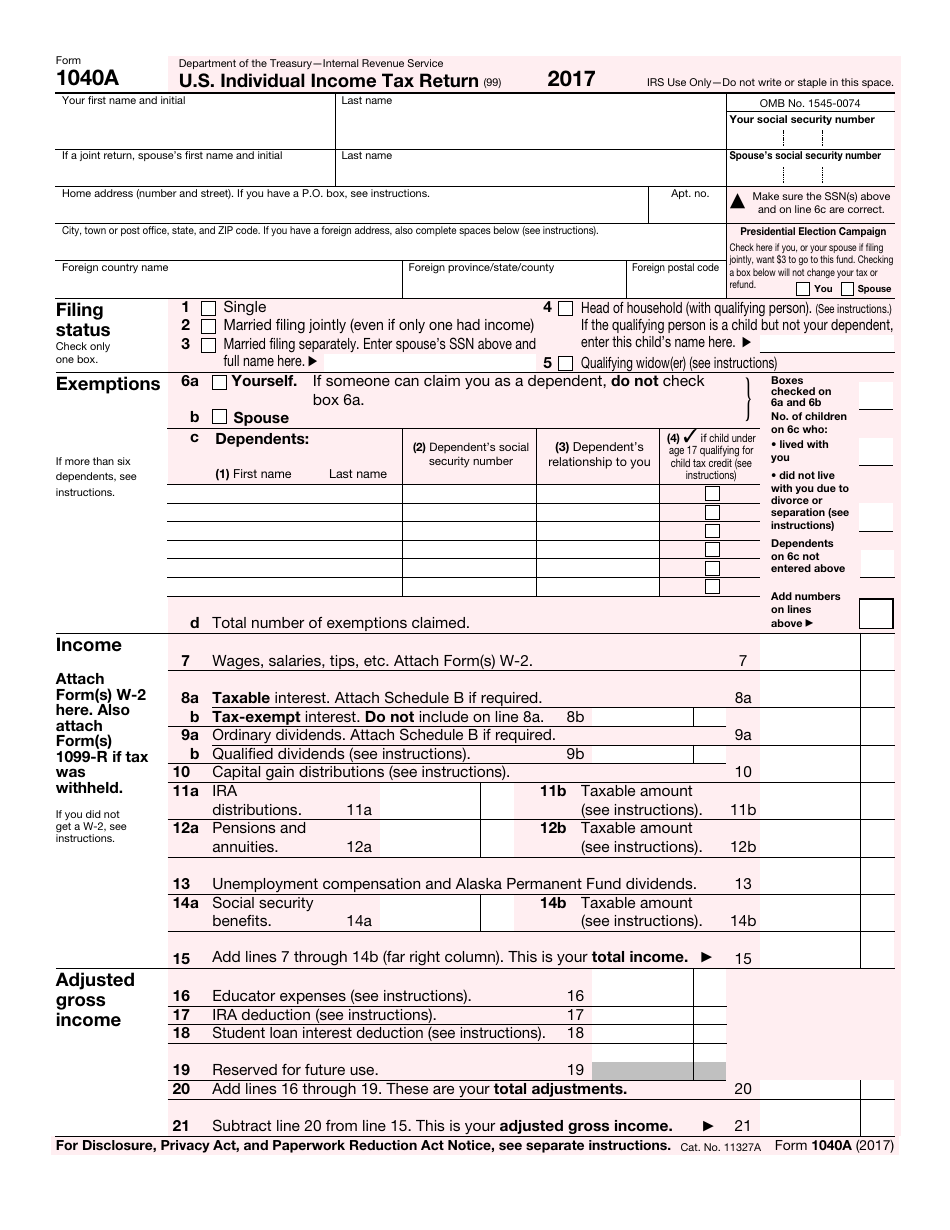

For example, if you needed to file a simple return, but you were also claiming the standard deduction and the earned income tax credit (EITC), you could use Form 1040EZ.įorm 1040 asks you to include information about dependents, while 1040EZ didn't allow you to claim any.

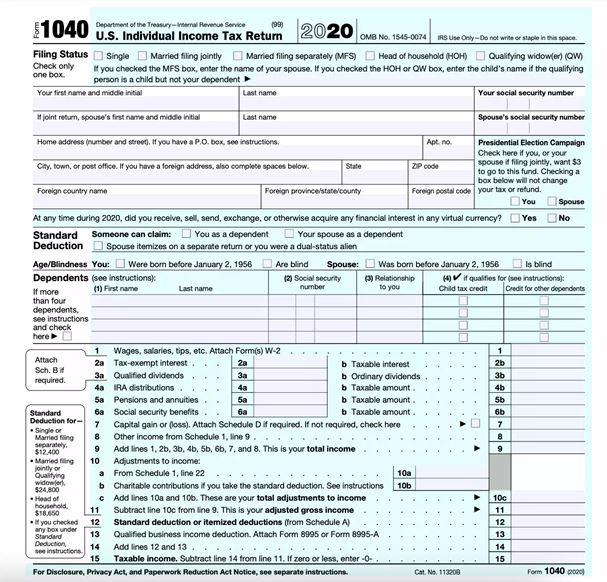

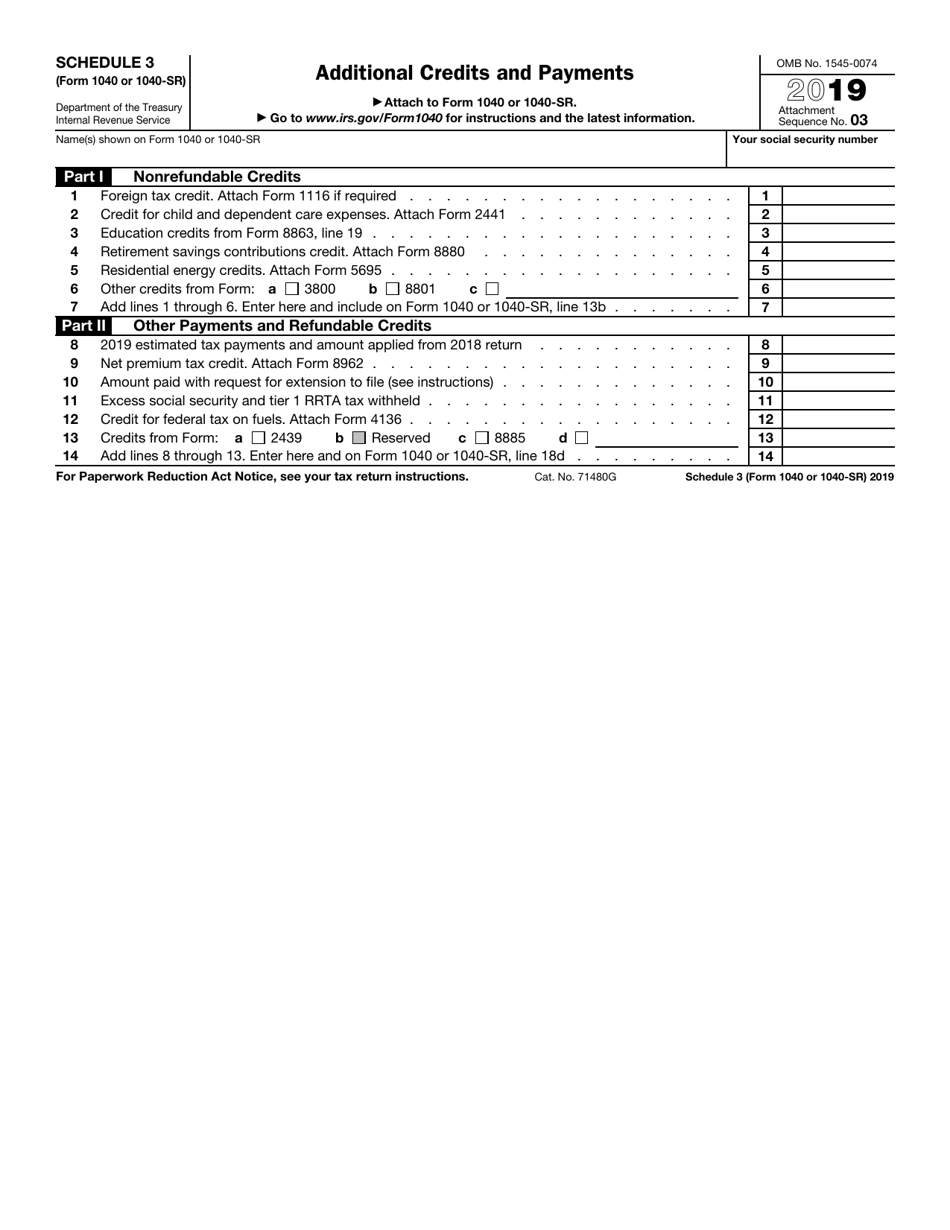

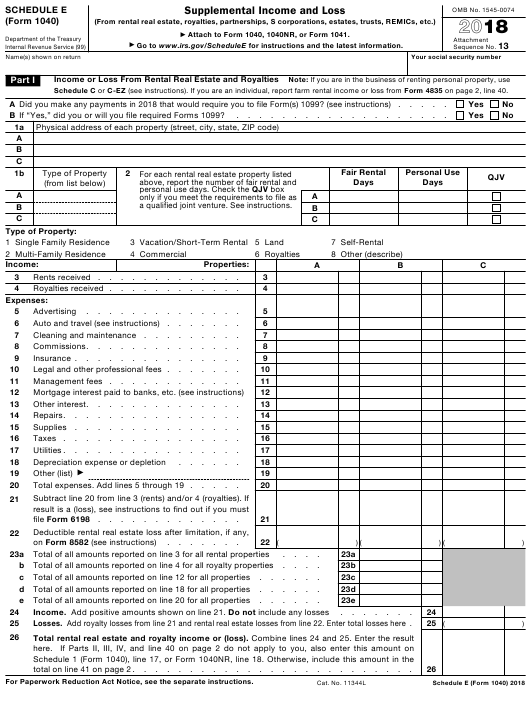

Form 1040īefore it was discontinued, Form 1040EZ allowed you to claim a handful of credits and deductions on your tax return. Depending on the types of income you report and the tax deductions or tax credits you claim, you may need to attach other forms or schedules. Form 1040 has replaced Form 1040EZ since tax year 2018, but if you haven't filed a return using Form 1040EZ for tax years 2017 and earlier, you may still access past versions of the form on the IRS website or through TurboTax's tax preparation software.įorm 1040 has separate sections where you report your income, tax deductions, and some tax credits to determine your tax bill and whether you owe money or can expect to receive a refund. IRS Form 1040 acts as one of the official documents that you can use to file your annual federal income tax return.

Now, through at least 2025, most taxpayers will use either Form 1040 or 1040-SR to prepare their taxes and file with the IRS. This form made it easier and faster to report basic tax situations.

0 kommentar(er)

0 kommentar(er)